connecticut sports betting tax rate

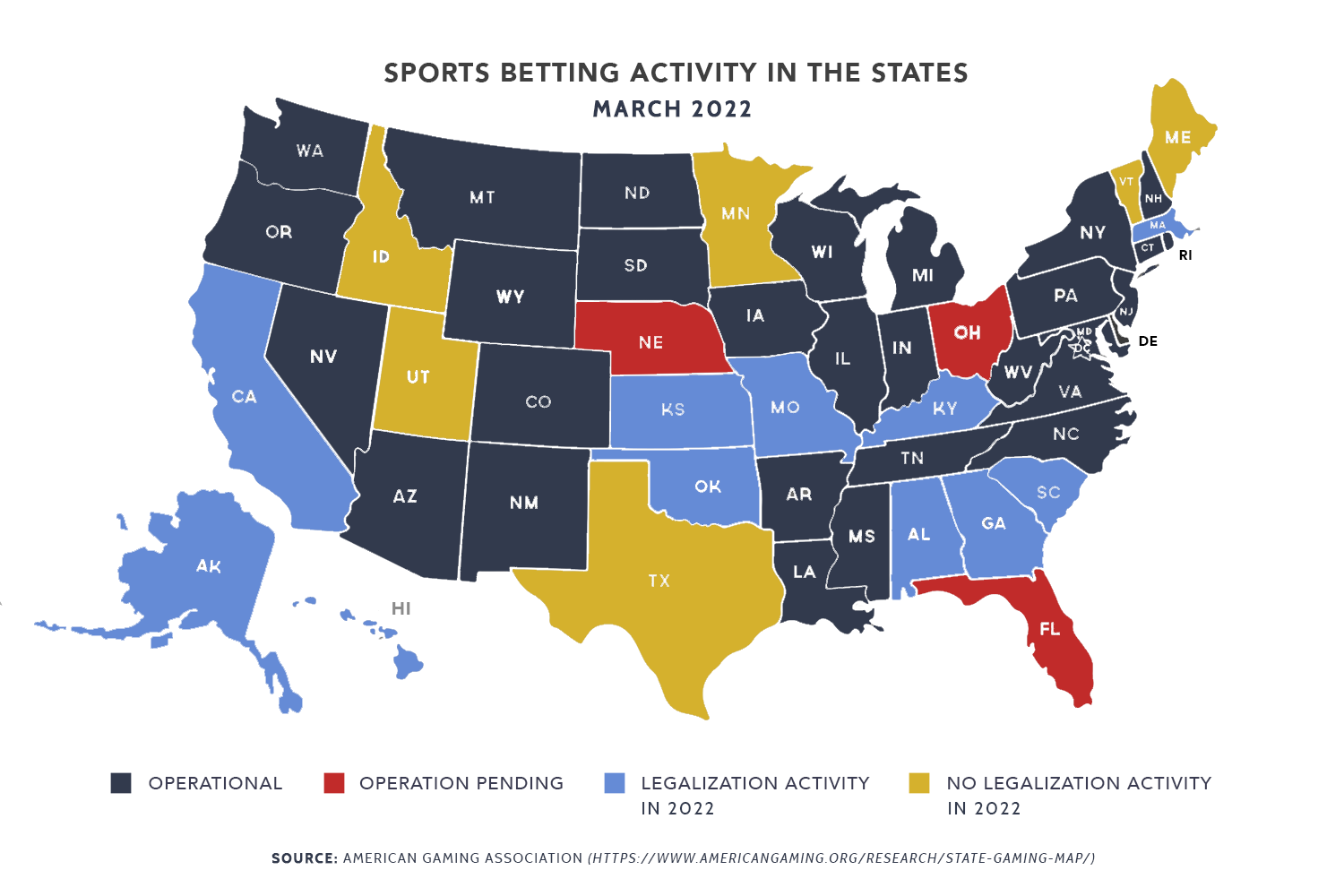

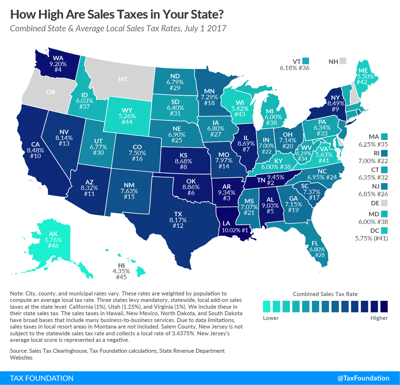

Aside from the 20 tax the state. This is in line with the national trends where the majority of states have opted for lower rates.

Best Sports Betting Sites Legal Online Sportsbooks 2022 The Kansas City Star

How States Tax Sports Betting Winnings.

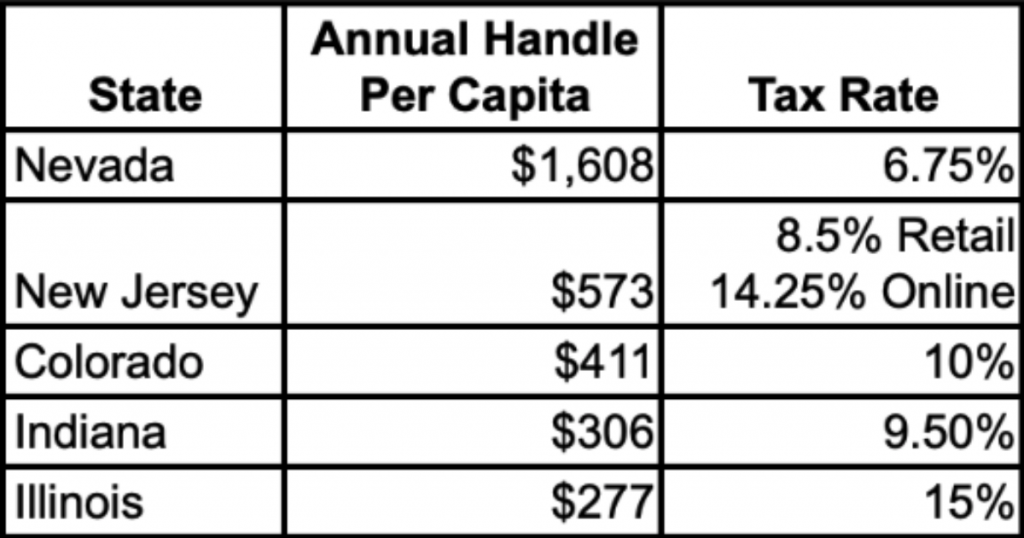

. That is higher than the rate charged in states such as Nevada. The Law Regulations and Technical Standards for all forms of Online Gaming. Connecticut Legal Online Sports Betting Tax Rate.

Get Up To 1250 Back As A Free Bet If You Dont Win. The Connecticut General Assembly has. Since the inception of legal sports betting in 2018 the Garden State has collected 1695 million in taxes from 135 billion in sports betting revenues.

Proceeds will go to a college fund to allow students to attend. 12000 and the winner is filing. Quick and Easy Payouts.

Ad Bet Online From Anywhere in Connecticut With DraftKings. States have set rules on betting including rules on taxing bets in a variety of ways. Quick and Easy Payouts.

Ad Bet On The NFL With Caesars Sportsbook. How To Book Sports Betting. Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with.

A 1375 tax rate on sports wagering and an 18 tax rate for the first five years on. The state to operate an online sports betting skin through the Connecticut State Lottery. He said the delay in allowing sports betting is costing the parties far more money than the difference in two percentage points on the tax rate.

The exceptions to the rule are Delaware New Hampshire and Rhode Island which. The gambling tax rate in the state of Connecticut is 699. Legal sports betting in Connecticut will begin sooner rather than later possibly in early 2021-22 as one of the first of a group of.

This does not explicitly state sports betting but. Connecticut sports betting totals Connecticut market snapshot. Legal Connecticut sports betting takes place online and in person.

Connecticut online sports betting took a major step forward this week after gaming bills advanced to the states House of Representatives. Since the tax year 2017 the IRS withholding rate for qualifying gambling winnings of 5000 or more over the course of a tax year is 24. The sports betting tax rate for CT is 1375 Connecticut lottery can take up to 15 retail sportsbooks Bettors cannot place wagers on Connecticut college sports teams.

The legislation is Public Act 21-23. Connecticut lawmakers set the sports betting tax rate at 1375 percent regardless of whether the gross gaming revenue GGR is derived online or at a land-based location. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds.

The Nutmeg State legalized. The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person. Thats good for an.

Las Vegas Odds Sportsbook Lines And Sports Betting Trends At. Connecticut sports betting apps pay a 1375 revenue tax. Taxes and fees for sports betting and iGaming.

Ad Bet Online From Anywhere in Connecticut With DraftKings. 10 on net sports betting proceeds. MOU Amendment - July 2021.

Ad Bet On The NFL With Caesars Sportsbook. In Maryland there is a gambling winnings tax rate of 875. Tax rate on sportsbook operators.

How Do Odds Work Sports Betting. Legalising Betting In Sports In India. Sports betting tax rate.

An Official Sports Betting Partner Of The NFL. How States Tax Sports Betting Winnings. A 1375 tax rate on sports.

Learn about CT betting laws the best legal sportsbooks promo codes bonuses and news. An Official Sports Betting Partner Of The NFL. The lowest rate is 2 whereas the highest is just under 6 at 575.

The tax rate in Connecticut on sports betting and fantasy sports is 1375 of gross gaming revenue money bet minus money paid out As a state entity the Connecticut Lottery. Get Up To 1250 Back As A Free Bet If You Dont Win. The IRS code includes cumulative winnings from.

Survey Sports Betting Preferences Among Massachusetts Residents

United States Sports Betting Index Consumer Choice Center

Connecticut Sports Betting 2022 Bet On Sports Legally In Ct

Study Reveals Allowable Deductions Impact Sports Betting Tax Receipts

Study Reveals Allowable Deductions Impact Sports Betting Tax Receipts

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Connecticut Sports Betting 2022 Bet On Sports Legally In Ct

Connecticut Sports Betting 2022 Bet On Sports Legally In Ct

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Connecticut Poised To Be Center Of New England Sports Bets Igaming

Connecticut Sports Betting 2022 Bet On Sports Legally In Ct

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings